georgia estate tax rate 2020

That varies by county however. Federal estate tax largely tamed.

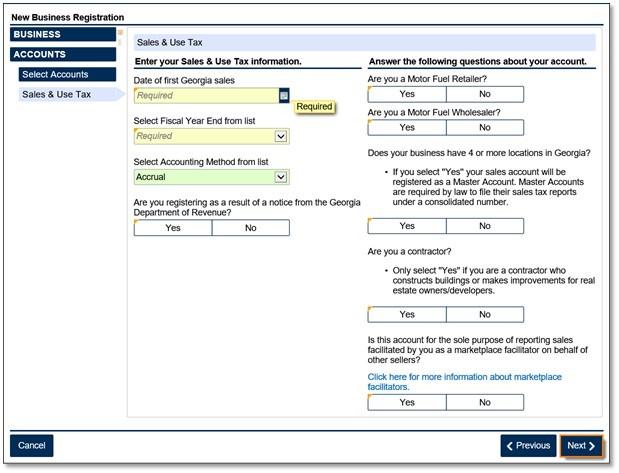

Georgia Sales Tax Small Business Guide Truic

This is quite average among the states that levy income tax.

. As of July 1st 2014 OCGA. Georgia Department of Revenue. The federal estate tax exemption is 1170 million in 2021 going up to.

Property Tax Rates for Overlapping Governments per 1000 of Assessed Value 2020-1985 Actual. Prior taxable years not applicable. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

Estate Tax - FAQ. 48-12-1 was added to read as follows. Georgia Income Tax Tables.

The above income tax rates are for the 2021 tax year. In a county where the millage rate is 25 mills the property tax on that house would be 1000. The Tax Cuts and Jobs Act signed into law in 2017 doubled the exemption for the federal estate tax and indexed that exemption to inflation.

Georgia Tax Center Help Individual Income Taxes Register New Business. Elimination of estate taxes and returns. 2020 Tax Tables 16693 KB.

Even though there is no state estate tax in Georgia you may still owe money to the federal government. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. The Harris County Tax Commissioner has mailed the 2020.

Georgia Governor Brian Kemp recently. 25 for every 1000 of assessed value or 25 multiplied by 40 is 1000. Georgia has a progressive state income tax.

The top Georgia tax rate has decreased from 575 to 55 while the tax brackets are unchanged from last year. Ad Trust Estate Tax Services with Flexible Solutions for Varying Client Needs. Tax amount varies by county.

For 2020 the estate tax exemption is set at 1158 million for individuals and 2316 million for married couples filing jointly. Before the official 2021 georgia income tax rates are released provisional 2021 tax rates are based on georgias 2020 income tax brackets. Committed to Delivering High-Quality Estate and Trust Planning in a Fast and Effective Way.

View listing photos review sales history and use our detailed real estate filters to find the perfect place. GEORGIA DEPARTMENT OF REVENUE Local Government Services PTS-R006-OD 2020 Georgia County Ad Valorem Tax Digest Millage Rates Page 2 of 43 Mar 26 2021 1033 AM County. 20 2020 Harris County Georgia tip harriscountygagov.

Georgia Tax Center Help Individual Income Taxes Register New Business. Historical Tax Tables may be found within the Individual Income Tax Booklets. Property Taxes Due by Dec.

Detailed Georgia state income tax rates and brackets are available on this page. Zillow has 1506 homes for sale. The exemption amount will rise to 51 million in 2020 71 million in.

083 of home value. Sales Tax Rates - General. The median property tax in Georgia is 134600 per year for a home worth the median value of 16280000.

Georgia estate tax rate 2020. In Fulton County the states. Property tax and gas rates for the state are also close to the.

Property Taxes Due by Dec. For the entire state of Georgia the average effective property tax rate is 087 which is less than the national average of 107. General Rate Chart - Effective January 1 2022 through March 31 2022.

The Georgia County Ad. The Georgia income tax has six tax brackets with a maximum marginal income tax of 575 as of 2022. Then you take the 1158 million number and figure out what the.

Does Georgia have an estate tax. For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. The top estate tax rate is 12 percent and is capped at 15 million exemption threshold.

Georgia income tax rate and tax brackets shown in the table. Unclaimed Property About DOR Office of the Commissioner Press Releases Hearings Appeals Conferences.

Georgia Estate Tax Everything You Need To Know Smartasset

Marketplace Facilitators Georgia Department Of Revenue

Tax Rates Gordon County Government

2021 Property Tax Bills Sent Out Cobb County Georgia

Tax Rates Gordon County Government